A virtual data room, or VDR, is a stage that stores private data utilizing cloud innovation. It has complex security highlights and sharing abilities that permit a smooth exchange among the organizations associated. It is currently supplanting physical information rooms due to easy availability, cost productivity, and high-security updates that guarantee the safeguarding of the institution’s database.

With the advancement of technology, the virtual data room is progressing in a lot of banks and financial institutions in today’s generation. It provides a secure data room for banking and other financial institutions. These virtual data rooms aim to establish a better relationship between the organizations and their clients. It also provides various solutions for online banking and better investment solutions in business organizations.

Mergers and Acquisitions or M&A holds a major part in the US economic system with over 1.8 billion-dollar deals. For the modern market, M&A transactions are extremely important. Also, M&A’s virtual data room is an ideal way of managing the operation. During consolidation or purchase, it serves as an important tool.

Significance of VDR in financial institutions and investment banking: –

- Effective transparency and comfort:

Virtual data rooms and a few other cloud-based services and tools enable bankers to connect and share information with their customers securely.

- Sturdy management of databases:

Online data rooms provide a highly secure environment for exchanging confidential documents between banks and third parties. It helps the organization handle contracts and procurement with its clients worldwide and completes additional legal transactions.

- Maximized value for various transactions:

Virtual data rooms help maximize transaction value by significantly reducing and preventing many of the expenses before a sale is done. Since there is nobody physically in the data room, VDRs can be created for customers worldwide, and there is no waiting time for them to access the data.

Benefits of using virtual data room for Mergers and Acquisitions: –

- All records, files, and transaction information can be validated, accessed, checked, and transferred easily irrespective of the seller and buyer’s position.

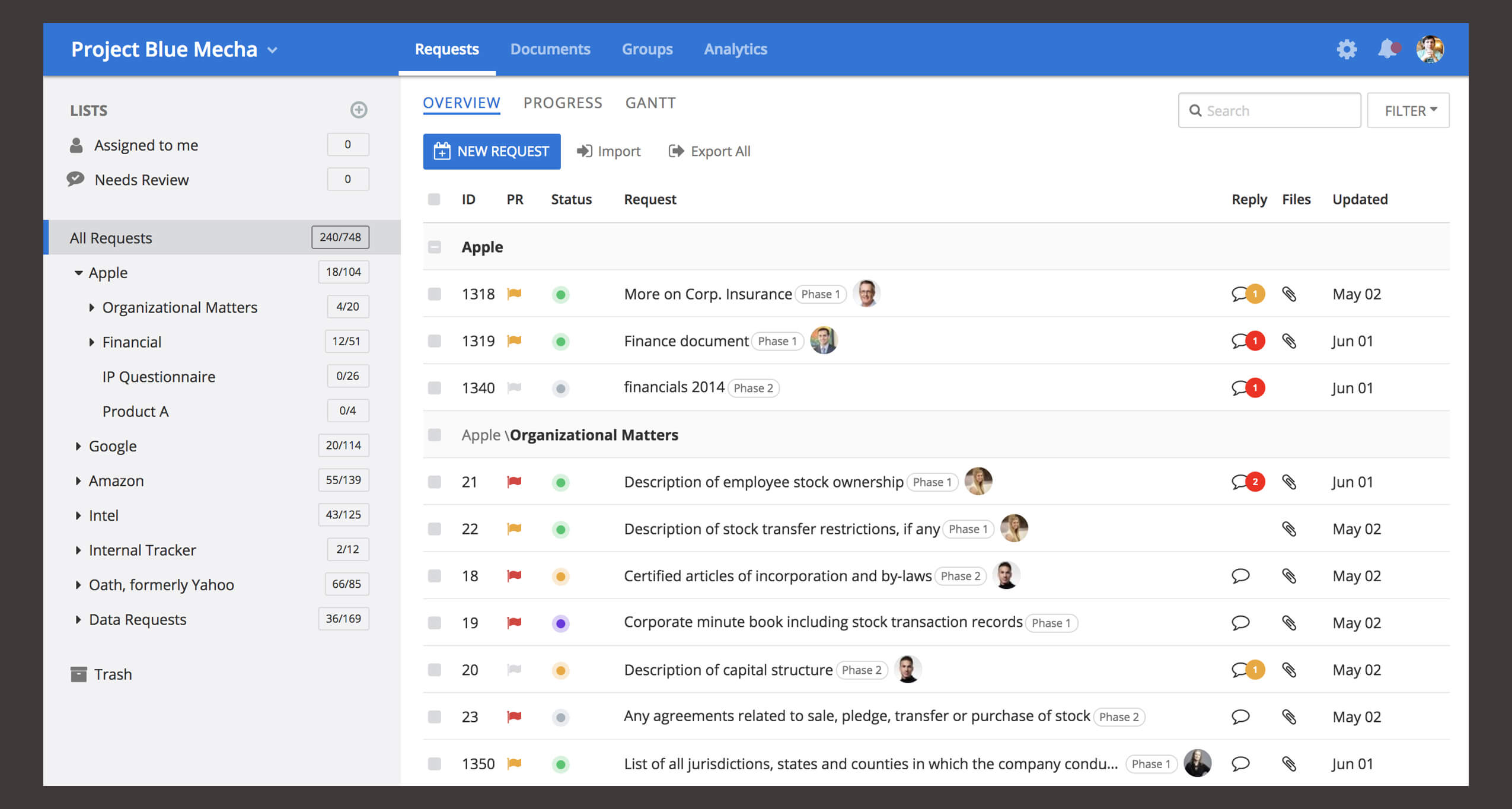

- Users can set searchable content, full-text search, and directories inside their VDR deal room by default.

- Digital acceptance and editing of documents is accessible to members of both parties. The preference is secure and can save work and effort.

- Records in the user’s digital data room remain secure and private with the most sophisticated security software.

- The user shall be notified even if one of the parties alters the material or has only access to the papers. It is a useful tool that updates the user about the recent activity in the data room.

- The room creates a checklist that allows the parties to quickly and efficiently access and view the data so that the user can link it to the given database.

With the help of online data room for banking users can transact easily and securely. The online data room for banking also provides better encryption to the documents which offline security fails to provide. Leading business organizations and financial institutions should invest in mergers and acquisitions and ensure the security of their important credentials.